In 2022 I founded JAN3, a company dedicated to facilitating the journey for new countries looking to step into Bitcoin territory. This was a year after helping with El Salvador’s Bitcoin adoption process. The reasoning was simple: if Bitcoin was to fulfill its promise of becoming the world’s new reserve currency, it would be only natural for nation states to pivot towards it.

Since its inception, Bitcoin has been likened to money or a commodity by any number of regulators, yet no matter their outlook, neither of these comparisons frames Bitcoin as an asset that in just a decade has attained similar status to thousand-year-old commodities such as gold or coffee. In 2024, Bitcoin ETFs trade in the same markets as these goods, while presidential candidates in the United States debate its role next to the almighty dollar in contemporary America.

Although headlines of “Bitcoin going mainstream” have adorned the pages of financial outlets for years now, 2024 is indeed the year where retail investors, Wall Street giants, politicians, governments, and companies can no longer ignore its importance.

Most Bitcoin innovation, at least in the early years, happened in a state of laissez-faire from governments, however, the current landscape suggests few countries can continue to remain indifferent. In Latin America, Bolivia recently lifted its Bitcoin ban after realizing what every nation will eventually have to accept: Bitcoin cannot be banned. Bitcoin is just information, and you cannot ban information.

From an ideological standpoint, many Bitcoin evangelists, educators, venture capitalists, and HODLers would prefer governments to stay out of their domain, but as Bitcoin’s price continues to increase and thus it keeps eating away at gold’s market cap, the likelihood of that happening is now close to zero.

What Bitcoin can do for your country

El Salvador’s Bitcoin policies sought to capture the full extent of what this technology is capable of doing. Bitcoin is both money and an investment vehicle for every Salvadoran, it’s an entry point to this once-forgotten country for businesses, it’s a national reserve asset for President Nayib Bukele’s government, or even a pathway to citizenship for foreign investors.

In other parts of the world, we are seeing nation states take to Bitcoin in at least one of these aspects. Similarly to how people looked to Bitcoin as a savings vehicle, governments are now holding hundreds of millions of dollars’ worth of Bitcoin, albeit accidentally in some cases.

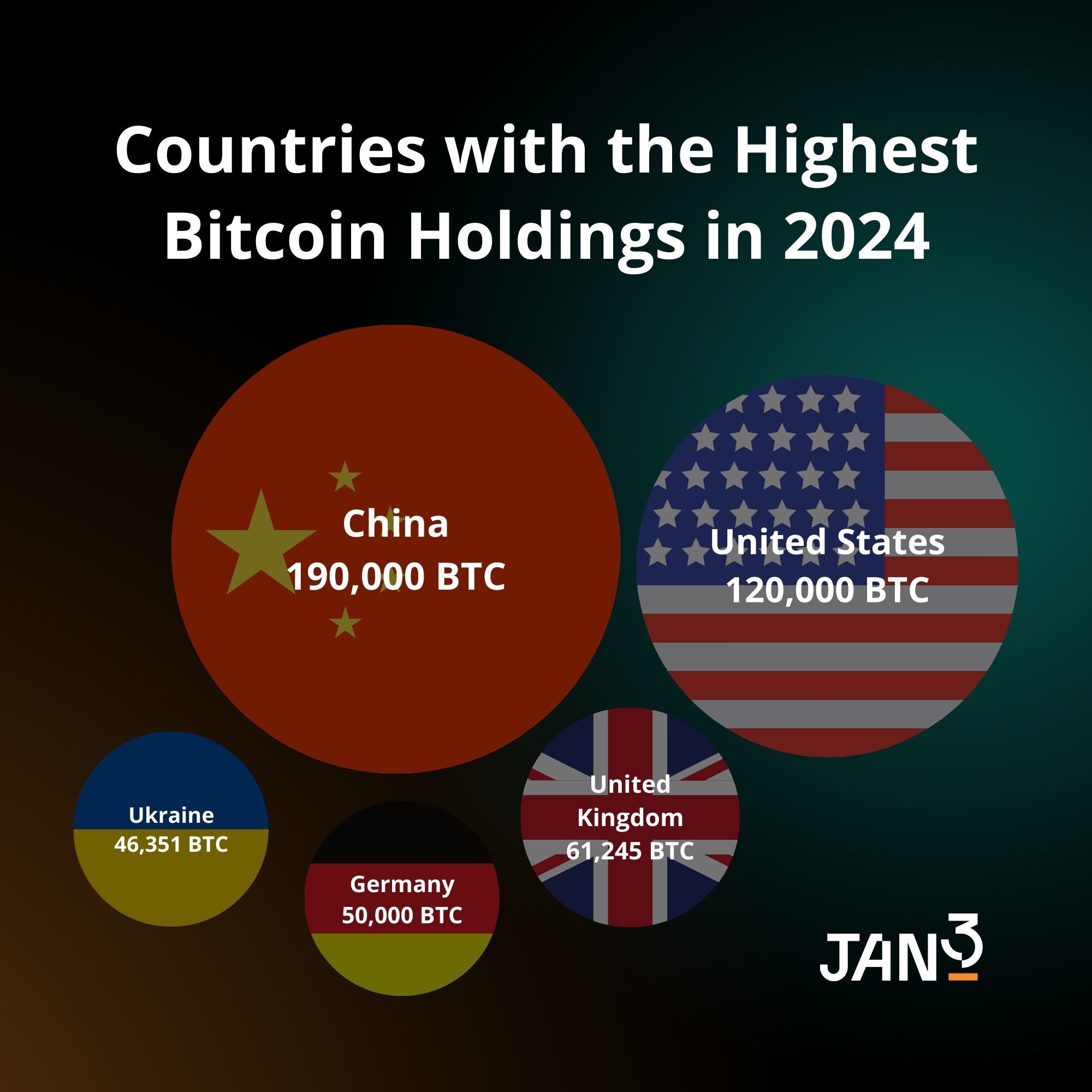

China leads the pack with close to 190,000 BTC, the US government follows with roughly 120,000 BTC (it holds 215,000 BTC but 95,000 belong to Bitfinex and must be returned), and the UK holds approximately 61,000 BTC. Up until July 2024, Germany held the fourth-largest Bitcoin holdings, although unfortunately it sold most of it, leaving close to USD 200 million on the table due to poor timing.

These countries have something in common: they obtained large amounts of Bitcoin seized from criminal procedures, as is the case for Finland and Georgia, with less than 100 BTC each. All hold Bitcoin for reasons that are not strictly related to Bitcoin investment.

Nevertheless, a second crop of countries hold Bitcoin because they choose to do so. While El Salvador is the prime example (5,840 BTC), Bhutan owns an unknown amount obtained from mining operations previously undisclosed to the public, as the tiny nation sought to leverage its vast surplus of hydroelectric power from as early as 2020.

Since the start of the Russia–Ukraine war, the latter has received millions of dollars’ worth of donations in Bitcoin. Both countries have striven to detach part of their finances from the modern banking system. In Russia’s case, this has perhaps been due to external pressure, as Western powers sought to close off President Vladimir Putin from the archaic SWIFT system.

It’s clear then that nation states opt into Bitcoin for the same reasons people do. Some are drawn to its unrivaled performance as an investment; others mine Bitcoin to take advantage of the resources they have in hand; and, lastly, some choose to use Bitcoin out of sheer necessity after being locked out of the legacy financial system, just as Venezuelans, Nigerians, Argentines, and millions of other nationalities across the rest of the developing world have been doing for years.

Now that presidential candidates such as Donald Trump and Robert F. Kennedy Jr. (who recently dropped out of the race and endorsed the former US president) have promised to make Bitcoin a proper reserve asset as policy, a new age where more countries buy and hold the asset willingly, in the same way they stockpile gold, appears imminent.

To this date the USA, China, and UK have yet to sell any Bitcoin, and with every passing day the value of those assets continues to grow as the purchasing power of their currencies shrinks at a now alarming rate for each.

Bitcoin politics

Donald Trump attended Bitcoin Conference 2024, alongside Robert F. Kennedy Jr.’s second consecutive appearance at the event, confirming a trend that we at JAN3 identified long ago: the birth of the Bitcoin lobby.

Just as tech, oil, pharmaceutical, or food and beverages companies hold enormous sway among political forces, Bitcoin companies are now part of the political arena. Unlike any of these, however, the Bitcoin sector does not yet represent mass consumption goods or services, but rather an industry that could now shape the energy policies of states, such as Texas, or elsewhere, entire countries, such as Indonesia.

With close to 3% of the world’s population believed to have owned or transacted Bitcoin at some point, it was only a matter of time before some of these very people rose to occupy public office. Whether it’s MP Joana Cotar in Germany, President Bukele in El Salvador, or the growing number of senators and representatives in the USA who have taken a pro-Bitcoin stance such as Cynthia Lummis or Justin Amash, the number of politicians advocating for Bitcoin will continue to grow.

The future is Bitcoin

We are only at the beginning of the Bitcoin adoption process, which can be likened to the average politician’s familiarity with the internet back in the 1990s. In 2024, not every country has specific regulations pertaining to the internet, and those that have looked to exert control over it have not necessarily managed to do so. We continue to be amazed — sometimes caught off guard — by the internet’s effects on modern society.

I predict a similar scenario for Bitcoin, wherein nation states that are open to maximizing Bitcoin’s full potential thrive, and those that are closed off to it fall behind. It’s important to remember that there is only a finite amount of Bitcoin for all 195 countries to accumulate.

It is quite fitting then that the USA and China hold close to 1% of the available supply of Bitcoin. We are at a unique point in history where smaller countries (and corporations) can rival those two with what will be seen as a relatively small investment in the future.

My pitch for most nation states is to start mining, purchasing, and allowing for the free flow of Bitcoin in their economies. As the path to hyperbitcoinization unfolds, they will see the value of their Bitcoin reserves eclipse that of their gold.

In 2024, the state of fiat currencies such as the yen, euro, or dollar is setting off alarm bells — meanwhile, Bitcoin begins.

This article was originally published by Henley & Partners as part the firm's "Crypto Wealth Report 2024" on August 27, 2024.